Unemployment Insurance Premium Differentiation

The unemployment insurance premium differentiation, also known as the low and high unemployment insurance premiums, is one of the most striking changes in the WAB (Labour Market in Balance Act).

As from 2020 onwards, it is no longer the sector in which the employee works that determines the unemployment insurance premium, but the type of employment contract that the employee has.

Depending on the type of employment contract, either the high or the low unemployment insurance premium applies.

The high premium will apply to:

- contracts for a definite period of time;

- on-call contracts;

- zero-hour contracts; and

- min-max contracts.

The low unemployment insurance premium exclusively applies to employment contracts for an indefinite period of time that have been laid down in writing. These employment contracts for an indefinite period of time must not be an on-call contract, a zero-hour contract or a min-max contract, because for those types of contracts the high unemployment insurance premium always applies.

However, the above does not apply to employees who are younger than 21 years who do not work more than 12 hours a week, because for these the low unemployment insurance premium can also be applied for a temporary contract. The government believes that it is advisable for this group to gain work experience in addition to the study. This hourly standard applies per declaration period; for a 4-week declaration, therefore, an hours standard of at most 48 paid hours applies, and for a monthly declaration an hours standard of at most 52 paid hours applies.

There also is another exception to the above arrangement. The employer may also apply the low unemployment insurance premium for employment contracts entered into within the framework of a work-study trajectory in the vocational learning pathway. With this exception the government wants to encourage employers to offer training places to students in vocational education trajectories.

In all cases, the low unemployment insurance premium may only be applied if a written employment contract is present at the wage administration. In the absence of a written employment contract at the time of wage payment, the high unemployment insurance premium will always have to be applied.

The expectation is that a low unemployment insurance premium for fixed employment contracts will make it more attractive for employers to give employees a fixed employment contract.

It has in any case been included in the legislation that the difference between the low unemployment insurance premium and the high unemployment insurance premium will be 5%. So if the low unemployment insurance premium is 2.5%, the high unemployment insurance premium will be 7.5%.

If the low percentage has been applied, in some cases it may be so that afterwards the high percentage must yet apply. This will be so in the following cases:

- If the employment ends at the latest 2 months after commencement. The reason for termination is not relevant;

- If an employee has been paid more than 30% extra hours within 1 calendar year than has contractually been agreed for that year (this does not apply, however, if 35 hours or more have been agreed in the employment contract).

In order to be able to check this, as from 1 January 2020 the type of employment contract must be clearly stated on the payslip.

The above also automatically implies that periods must be reprocessed, and that an adjusted (additional) wage declaration must also be submitted. This naturally increases the administrative burden considerably.

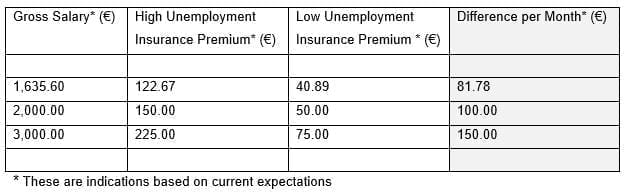

To give you an impression of the differences in costs, we assume a percentage of 2.5% for the low unemployment insurance premium and 7.5% for the high unemployment insurance premium.

The above change will for many employers result in higher costs. However, it also offers opportunities. More than before, you can make a well-considered choice between costs and risks.

We advise you to make an inventory of your workforce and to find out for whom you have to apply the high unemployment insurance premium. For example, it may be interesting to convert some of your employees’ employment contracts for a definite period of time into contracts for an indefinite period of time. This can make a big difference in the premium that you will have to pay. Of course, there are also risks attached to this, because you will then no longer have an end date on which the employment contract ends.